CoinTracker raises $1.5M to make tracking crypto investments easy for anyone [TechCrunch]

It’s April, that means tax returns for people in the U.S. very soon. Given the breakout year that crypto had in 2017 — despite prices cooling down in recent months — and well-intended individuals might be thinking about whether to file taxes based on gains they enjoyed from bitcoin or other cryptocurrencies.

It’s good timing, then, for CoinTracker — a San Francisco-based startup currently tracking $200 million in crypto assets — to pop its head above the parapet and announce that it has raised a $1.5 million seed round.

We wrote about the company earlier this year when it was part of Y Combinator’s winter cohort, and now it has spread its wings with a round led by Initialized Capital — a seed investor in billion-dollar crypto exchange Coinbase — with Y Combinator and a host of angel investors joining in for the ride. Some of those include Protocol Labs CEO Juan Benet and Paul Buchheit, the engineer who created Gmail.

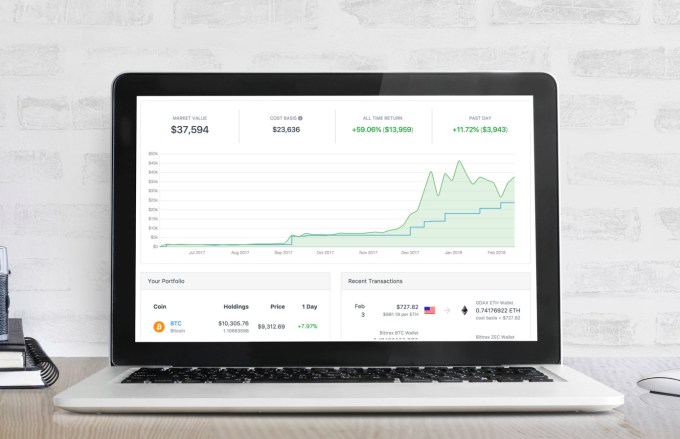

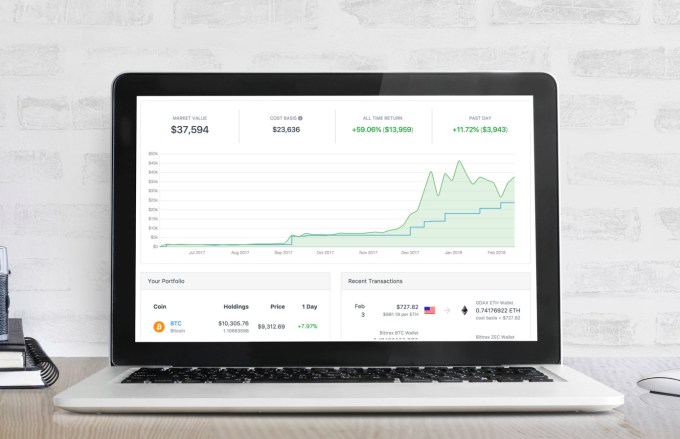

CoinTracker is (as the name suggests) a product that lets you track your crypto portfolio.

Sure, there are a tonne of such services and apps on the market but, having bought and used most of them, there’s none that really fits snuggly. That’s because a lot of the data input is manual. That’s important if you truly want to track the success of your investing, you need to know obvious information like what the price of bitcoin was when you bought. When you factor in crypto-to-crypto trading — e.g. trading bitcoin for ethereum — and the price changes that happen, suddenly your manual attempt to track performance is lacking.

That’s just speaking as a hobbyist. More serious investors are even more underserved, and that is where CoinTracker is aiming to make its mark.

The service tracks your crypto across wallet addresses — using public information, nothing private — while it throws in API keys from the top 14 crypto exchanges. That helps fill in more gaps and give you a fuller read on how your crypto investment has performed. A transfer matching algorithm is in place to help figure out trades on decentralized exchanges, which are more complicated to track.

By pulling that information, CoinTracker is also in a position to help those well-intended individuals I mentioned earlier give the taxman an accurate read on they crypto gains to remain IRS compliant.

Going forward, the plan is to tap into that holistic picture of crypto portfolios to offer more services, CoinTracker co-founder Chandan Lodha told TechCrunch in an interview.

Lodha, formerly a product manager with Google X, started the service alongside co-founder and former TextNow CTO Jon Lerner because both were looking for something to track their crypto investment hobby. When they realized a whole lot more people — both on the more serious and casual end of the spectrum — were too, they made it their main focus.

Lodha said the service aims to set itself apart with a focus on ease of use and simplicity, and he expects that to continue and be reflected in future services that could include trading via exchanges inside the app.

“The key reason we’ve had some success to date is due to focusing on the UX,” Lodha said. “There are tonnes of other tools but one thing that really resonates with our users is that we’ve made it easy to use for mainstream people, not just expert cryptography folks.”

Indeed, gathering and acting on user feedback is a common theme with Lodha, who said the money will go towards adding to CoinTracker’s developer team to work on the “large number” of user requests received.

Now to price: the basic tracking service is free, but users pay from $49 up to $999 per year for more advanced features centered around optimizing tax filings by computing capital gains reports using FIFO, LIFO or HIFO accounting.

Disclosure: Writer owns a small amount of cryptocurrency.

Source: TechCrunch https://techcrunch.com/2018/04/10/cointracker-raises-1-5m/

Post a Comment